What does retirement look like for you? Will you be pursuing your hobbies? Spending more time with your grandchildren? Will you be volunteering? Take a moment and close your eyes. What does retirement smell like? Are you and your grandchildren baking cookies to donate at the non-profit where you volunteer?

You started working decades ago. You’ve known that one day you would retire. It’s never too early to begin planning for your retirement. Even if you’ve procrastinated, now is a good time to begin.

To help you prepare for the retirement planning process, the following is suggested as your guide:

Know your expenses

A great starting point in the retirement planning process is knowing your current expenses and income. The second part is understanding what your expenses and income will be in retirement. Your financial planner will ask you about your income and expenses.

It’s a possibility that you’ll be retired for almost as long as you worked. Decades! You owe it to yourself to figure out your expenses, and by that I mean, ALL of your expenses.

In addition to your essential expenses, be sure to include your lifestyle and occasional expenses. Neglegting to include your fun money is a HUGE mistake. The cost of lifestyle expenses are commonly underestimated. Your goal is to create a retirement from a positon of intention, rather than default, right?

Prepare for your financial planning appointment

Retirement is a big deal and being prepared for your appointments is too. We provide this Checklist for both your initial appointment, as well as, annual plan updates.

Prior to scheduling your initial appointment, the following forms need to be completed and returned to our office:

Practice living on your retirement income

Experiment time! Once your retirement income and expenses have been determined, it’s a good idea, as a pre-retiree, to practice living on your retirement income.

You can continue working if you feel like your cash flow is too tight. If you still want to retire on a specified date, you have time to re-examine your spending, make adjustments to your expenses and/or line up part-time work in retirement.

The retirement income experiment may surprise you. You may discover that you can get along on your retirement income, opening possibilities such as early retirement.

Find out your company’s retirement processing dates

You’ve heard the phrase, “timing is everything.” What deadlines will you need to meet, with paperwork in good order, in order to retire on your target retirement date?

Some companies process retirement requests just twice a year, January 1 and July 1, for example. Others allow you to retire when you choose, however in the case of ESOPs, Employee Stock Ownership Plans, retirement plan distributions may be processed once a year.

Timing is key, especially if you’re planning on receiving income from a pension or employer sponsored retirement account.

Set aside cash reserves for retirement projects

When you’re retired, every day is a Saturday.

What day of the week do you typically start a project? It’s Saturday, isn’t it? Saturdays tend to be project day and are therefore, a popular day for spending money. If every day is a Saturday in retirement, you want to be sure you have a spending plan. Without a spending plan, you run the risk of running out of money.

I’d guess you have a few projects on your “when I retire” list. Let your financial planner know the estimated costs, and make sure your retirement plan includes those projects.

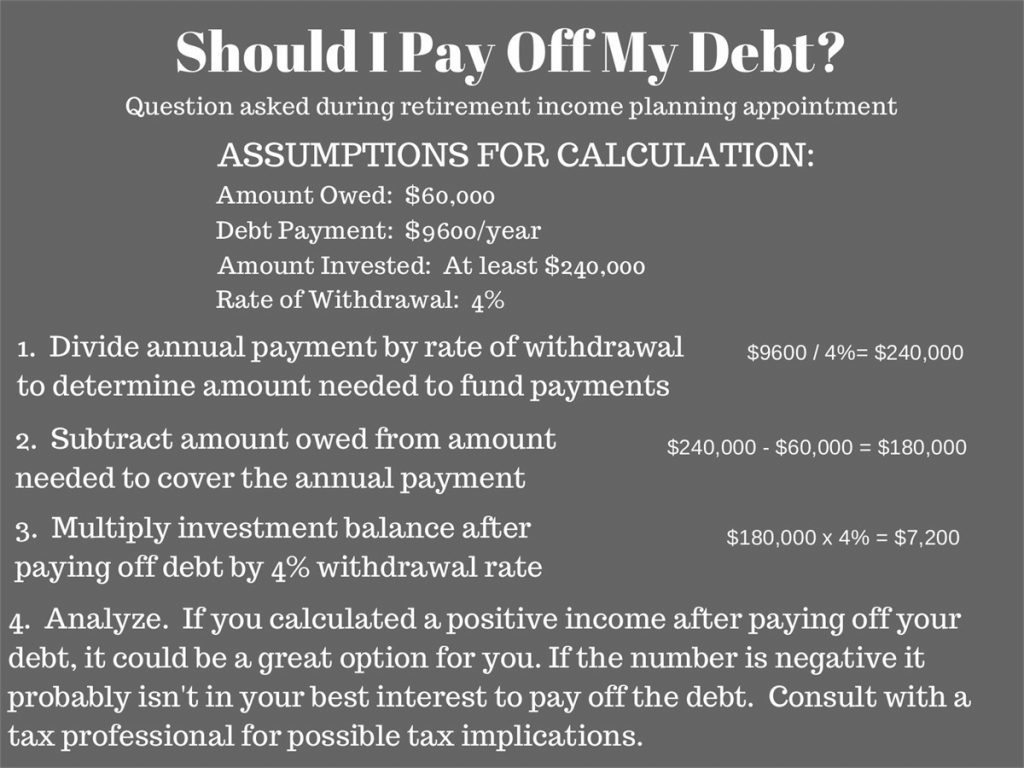

Pay off debt

The less debt you have in retirement, the less income you need. A 3-4% withdrawal rate is commonly accepted among financial professionals to be a prudent withdrawal rate for purposes of maintaining the principal balance, your retirement nest egg. While a 3-4% withdrawal rate is considered prudent, it is wise to consult with your financial planner to determine the best course of action based on your unique situation.

Not all scenarios are identical to this example so ask your financial planner to analyze various scenarios for you. By educating yourself on the benefits, trade-offs, and impacts to your comprehensive plan, you can make an informed decision. Remember to consult with your tax advisor before taking action.

Review your insurance coverage and needs for costs and options

The cost of insurance is a major concern for many pre-retirees. I recommend that you consult with your insurance agent early in the retirement preparation process. This is a good time to review your home and auto coverage as well as your life, disability, Medicare Supplemental (Medigap) and long term care insurances.

Health related insurances are important and are a significant expense in retirement, so it is wise to plan ahead.

Medigap insurance has a limited time frame for open enrollment and applications can be denied in certain cases of pre-existing conditions when application is made outside of the Medicare Supplement Open Enrollment Period. For more information visit medicare.gov.

Do you intend to retire before you’ll be eligible for Medicare? If so, investigate if you’ll receive employer provided health coverage as a retiree benefit. There may be an option where you can continue your health insurance coverage by paying the premiums yourself.

If you are married, do you have the option of going on your spouse’s health insurance plan?

It might be necessary to get your health insurance on your own by purchasing it in the market place.

What are the consequences and risks of not having health insurance? Learn more at https://www.healthcare.gov/fees/fee-for-not-being-covered/.

Plan for your unused sick, holiday, and vacation days

Will you lose your days if you don’t use them? Do you get paid for the days you haven’t used? Consult with your employee benefits specialist in advance so you know your options.

Ensure that your estate plan is up to date

How long has it been since you sat down with your attorney and reviewed your estate plan? A lot can happen in a year. A lot more can happen over the course of several years; marriages, divorces, children, grandchildren, new homes, businesses, etc. The time to plan for an emergency is before it happens. Schedule your estate plan review, or have your initial estate plan complete, before your retire.

Your estate plan should be comprehensive in nature, which means that in addition to a will, it could involve a trust or trusts, power of attorney and patient advocate directives. Give consideration to whom you would like to act on your behalf. What if that individual was unable or unwilling to serve? Who would you want to be next in line? Who would be 2nd and 3rd in line?

Do you own multiple properties? Would you like one or more to remain in the family upon your passing? Would you like to leave property to your favorite charity or cause? Discuss your intentions with your attorney and tax professional.

Business owners: are your business succession, buy/sell, and business continuity plans funded and up-to-date?

Keep in mind that there are costs associated with estate planning. The more complex your situation, the more your estate plan will cost. Ask your attorney for an estimate prior to engaging in the estate planning process.

Your estate plan, once it is created, will need to be reviewed and possibly modified periodically. Your family structure and your wishes will change over time. I recommend that you get your eyes on your estate plan on an annual basis. New Year’s Day is a good day, what else are you going to be doing? If you discover that your plan is not aligned with your current wishes, contact your attorney for updates.

Laws will continue to change. Ask your estate planning attorney what they recommend for frequency of formal estate plan reviews.

Know where you stand financially

Ideally, if you’re about to retire, you have an income plan. You know the accounts from which you’ll be taking an income. Your financial planner has advised you on the best time to start taking Social Security, and if you’re eligible for a pension, you know when you’ll start receiving your pension benefits.

You’ll know if you need to work a part-time job to supplement your retirement income. Maybe you’ll want to work for fun. Many retirees find low-stress jobs with friendly people to provide a social outlet and help stave off boredom.

If you haven’t met with a financial planner it’s time to schedule your appointment. You may be pleasantly surprised. Maybe you get to retire early. On the other hand, you could get a dose of reality; retirement is further away than you had hoped. Either way, you’ll know where you stand and can decide what actions to take so that you can do those things and smell those smells that you’ve dreamt of experiencing in retirement.

What does your retirement smell like?

Do you smell the damp, fertile soil, as you weed your garden?

Are you at the lake, taking in the smell of the lake air as you catch your first fish of the day?

Does retirement smell like fresh cut grass at your favorite golf course?

Melissa Myers, CFP®

Melissa is a Gen X business owner and CFP® professional.