Personal finance is personal. When it comes to your assets and the management of your wealth, that’s personal too.

Consider this statement…A million dollars isn’t a lot of money anymore.

Is she serious?

Is that what you’re thinking? Why would I say something so absurd?

It’s because I work with clients who, when we first started working together, asked questions like these:

Q: Am I on the right track?

Q: Should I be doing something different with my money?

Q: Since I’m getting older, do I need to be more conservative with my investments?

Q: Can I afford to retire?

Q: How much do I need in order to retire?

My A: IT DEPENDS.

Lifestyle

One of the first things I do with new clients is a lifestyle assessment. Your lifestyle, not your BFF’s lifestyle, not your neighbor’s lifestyle, Your Lifestyle.

Do you want to maintain your lifestyle, enhance it, or settle for less? I’ve yet to hear someone tell me they want less. If you’re like most people you want to maintain your lifestyle, if not add to it a bit.

When we talk about your lifestyle, what we’re really talking about is how much money you spend now and how much you’re likely to spend in the future. Let’s not forget about inflation. And taxes.

It isn’t your “bills” that can be problematic. You know, the essential expenses like housing costs, groceries and transportation. Typically, the “problems” with spending are associated with discretionary (lifestyle) expenses. From shopping and personal care to the biggies like home improvement projects, travel, memberships and dues, and YES, even dining out. Those are expenses that can present challenges when it comes to maintaining your nest egg.

“I spent how much?”

Variable AND discretionary expenses could make your nest egg disappear.

Why? It could be because pen has not been put to paper. In other words, if you don’t want to run out of money in retirement, it’s imperative to understand where and how you spend today and how you plan to spend in the future.

Income

After getting clear on what your lifestyle costs are today and will be in the future, we get clear on where your retirement income will come from.

Potential retirement income sources can include:

- Social Security

- Pension

- Business Income

- Rental Income

- The sale of real estate or other large asset

- Your investments

The reason you’ve been saving and investing all along has been to give you something extra in retirement. Right?

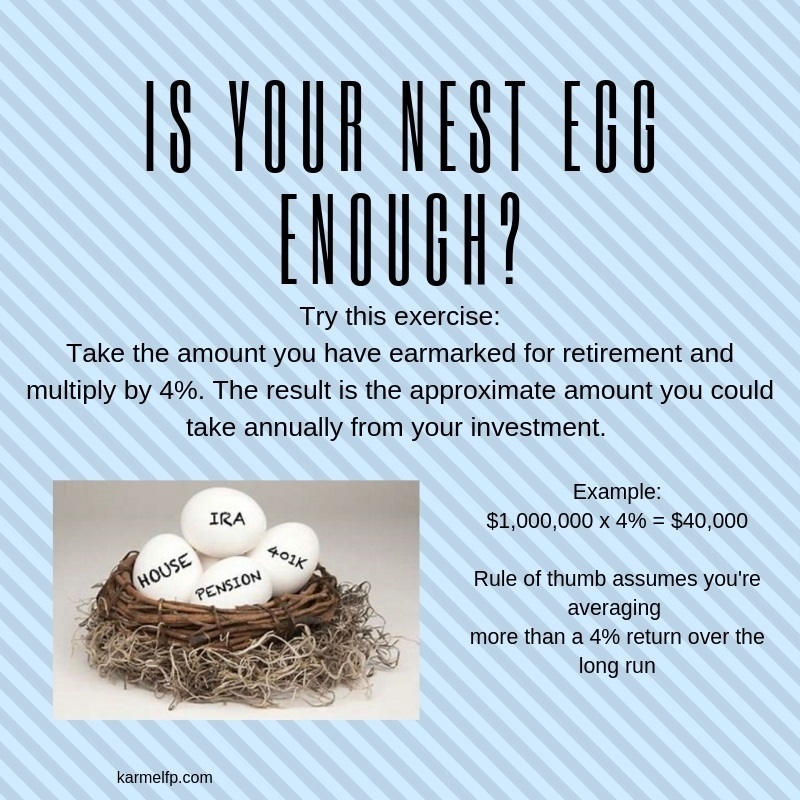

Will your nest egg be enough to last you the rest of your life? Let’s find out.

The Quick and Dirty

The rule displayed is a mathematical concept and does not guarantee investment results nor functions as a predictor of how an investment will perform. It is an approximation of the impact of a rate of return. Investments are subject to fluctuating returns and there is no assurance that this strategy will be successful.

This is an exercise you can do if you’re still working or if you’re already retired.

$40,000 Gross. Before taxes!

Not sure if your investments are working hard enough for you?

Wondering if you’re able to reduce some volatility in your portfolio?

Get a second opinion from Melissa.

Bottom Line

If you currently live on a 6-figure annual household income, Social Security and a million bucks probably isn’t going to cut it.

Take a look at how much you spend. Include both the essential and discretionary expenses. To maintain your lifestyle do you need more than $40,000/year?

If so, will your other sources of income make up the shortfall? Remember to include rental income, business income, the sale of an asset, etc.

Unsure?

Overwhelmed?

Hire a CERTIFIED FINANCIAL PLANNER™

Melissa Myers, CFP® is ready to help you make sense of it.

Can you Enhance Your Lifestyle?

Would you like to find out if you’re in a position where you are able to spend a little more and do some of the things you’ve been putting off?

Have you said something like, “it would be nice to be able to…”? Would you like to find out if you can?

Melissa Myers, CFP® will help you get answers!

“We wish we would have worked with you twenty years ago.”

Hindsight is “20-20.” Whether you’re already retired or working toward retirement, it’s NEVER too late to get clarity on where you stand with your personal finances and wealth plan.

Schedule a Complimentary Welcome Call with Melissa Today!